How to Know if You Are Financially Healthy

- Kelly Dunning

- Oct 22, 2019

- 4 min read

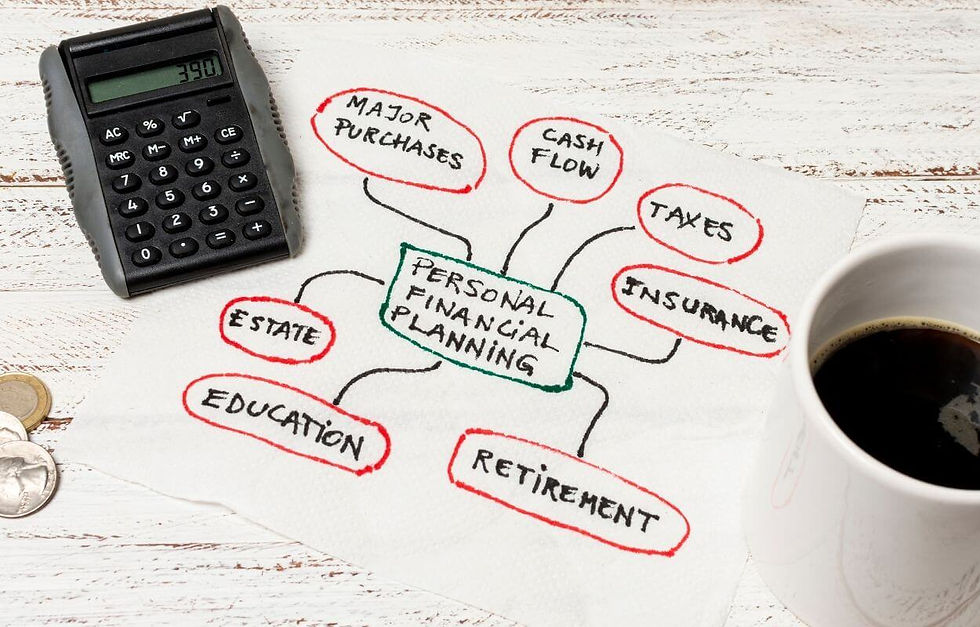

What does it mean to be financially healthy? Financial health refers to the state of your personal financial situation.

Generally, it means that you have a solid grasp on your finances and you have plans in place for a stable financial future. However, just having a high income doesn’t necessarily mean you are financially healthy. It’s what you do with the money you earn that really counts.

Everyone’s situation is different, but if you aren’t financially healthy this can cause a lot of stress and instability in your life.

How Do You Know If You Are Financially Healthy?

There isn’t one single, specific indication that lets you know whether or not you are financially healthy. In fact, there are multiple factors you should look at to determine your state of financial health. Here are a few of the most important ones.

You’re Spending Less Than You Earn

Of course, one of the biggest indications of financial health is simple. Is there more money coming into your accounts than there is coming out of it? If you are not spending less than you earn, you’ll never get ahead. It creates a cycle of always relying on debt, which can lead you deeper and deeper into a hole that is difficult to get out of.

If you take stock of your finances and realize that you are spending more than you earn, it’s time to make an adjustment. You can either make more, spend less or work out a combination of both that will have your finances in the black instead of in the red every month.

You Have an Emergency Fund

Having an emergency fund is a great indication of strong financial health. You never know what might happen, so a fund like this will protect you if things go wrong.

A good emergency fund should have approximately 3-6 months of your living expenses in cash.

If you are feeling uncertain about your financial life, you might want to have even more.

It should be in a bank account that you can access easily if you ever need to. (Don’t worry about this money not earning you interest - that’s not what it is for.)

You’ve Mastered Your Cash Flow

Cash flow is a very important indication of financial health.

You should know exactly how much money is coming in and out of your financial life. You should be able to pay all your bills in full every month, with enough money left over for spending and a bit of savings.

You may have a lot of money tied up in assets, but if you don’t have good cash flow you can still find yourself having to rely on debt. (Not to mention the stress that comes with living paycheck to paycheck.)

A sign that you haven’t mastered your cash flow is if you still have a lot of credit card debt. This type of debt is expensive and the high interest rates can be avoided if you pay it off every month. If you still have credit card debt, focus on paying that off first before you consider other financial strategies such as investing your money.

You Regularly Check In With Your Money

Checking in with your finances on a regular basis is a great indication that you are financially healthy. It helps you know exactly where you are at, so you can make smart decisions regarding your money.

If you aren’t regularly checking in with your money, you might be spending more and saving less than you realize.

It’s quite easy to blow through money quickly without realizing where it is going. It’s important to know the cold hard numbers, because they are always different than what you were estimating in your head.

It doesn’t matter whether you tally up your finances on paper, on a spreadsheet or within an app. What matters is that you are regularly checking up on your financial health and adjusting your habits and priorities based on what you discover.

Your Investments Are Diverse

If you have an investment portfolio, the more diverse it is - the healthier it is. We’ve mentioned on this blog before about how important it is to diversify your portfolio. Yet, it bears repeating again. You never want to put all your eggs in one basket - as the market is unpredictable.

One advantage to fractional ownership investments like Partbnb is that they are naturally diverse. It’s much more flexible than owning an entire property yourself.

The property is divided up into 10,000 parts, starting from only $34 each. You can buy as much or as little as you like - and buy and sell parts of your investment at any time.

You Are Always Learning

Another sign of financial health is that you are committed to learning about how to make the most out of your money.

As we stated in the Secrets to Investment Success, one of the most important factors in your financial health is being always open to learning something new. Sometimes what happens is that people start to improve their finances, then sit back and relax when they have learned enough to see a small improvement.

If you really want to be financially healthy over the long term and continue to grow, you need to never stop learning.

There’s always something more you can learn and it’s essential to keep working on your finances so you can keep improving your spending, saving and investing habits. Fortunately, there are many great online resources, podcasts, books, workshops and seminars where you can learn about how to make the most of your money.

Fractional Ownership: A Financially Healthy Move

At Partbnb, we offer you the opportunity to own a small slice of paradise. You can own as much or as little as you like - it’s up to you. Plus, your property will be earning vacation rental income without taking up any of your time, thanks to our professional property management service.

Click here to learn more about investing with Partbnb.

Comments